Catalysts:

Company transitioning in the ecommerce era by targeting women age 35-55 (not really affected by “influencer” marketing on social media

High retention rate among customers

Market leader with moat

Pandemic boon for business

Risks:

High debt

Competition with ecommerce businesses such as Amazon or Walmart will be hard

Financial Analysis:

Valuations:

My personal Biases:

I’m afraid of the debt and the inability of the company to refinance it - gut feeling

I don’t think the company should be returning money to shareholders right now

Assumptions:

2021 numbers same as TTM for simplicity

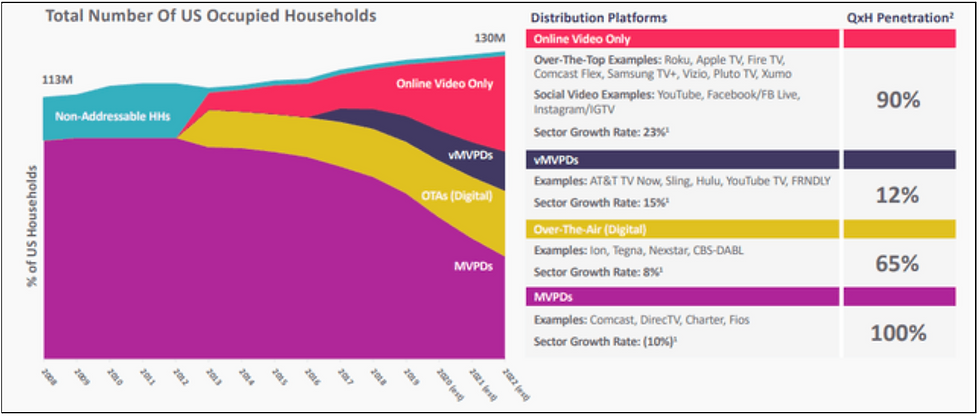

Revenue growth of 4%, 3%, 20%, and 5% respectively for QxH, QVC International, Zulily, and others

Operating margins of 14%, 14%, -10%, and -5% respectively for QxH, QVC International, Zulily, and others

80% of operating income converted into net income

FCF margin 2 percentage points higher than net income margin

Let’s see a scenario where the company maximizes repayment of debt

Enough cash left to return to shareholders

Discount rate of 18% for FCF

Terminal growth rate of 2%

Margin of safety of 30%

Exit Multiples based on P/FCF Ratio

Sales 10% higher in bull case and 20% lower in bear case

Shares outstanding stays the same

Conclusion

Looks undervalued but I will need to do further research to consider making an investment

Comments